Buy Now Pay Forever: The Real Cost of Credit Card Debt

I think the whole world has gone insane. Since when does it make sense to buy something on credit? When did society shift from one were you stood on your own two feet and had to prove you did not need the money to borrow from the bank. Today, most banks, credit cards, and consumer companies will give you credit if you are breathing. Even car dealers will give loans to almost anyone that walks in off the street.

A few months ago, I ran into a friend I had not seen in some time at a local bagel shop. We had the typical catch up chit chat as we waited in line, but I could tell that my friend seemed very far off and troubled by something. I offered to purchase her breakfast and asked if she would like to sit and catch up while we eat.

I was astonished to hear that she and her husband of 15 some odd years were getting a divorce. But the true shocker was yet to come; hang on to your hat or sit down if you need to. She began to tell a financial story that made me sick, and it was not even my debt. She explained how they had amassed 70+ thousand dollars of credit card debt, along with many other debts, and home refinances that they had run up together over the years. Yes, you heard me correct. And I had to ask three times to make sure I heard her right: 70+ thousand dollars in credit card debt. I wanted to slap her and yell at the top of my lungs “ARE YOU STUPID”, but the compassionate side of me just gave her a hug as she began to cry. As she sobbed she just keep saying, “he always told me we were fine. I had no idea we even had any credit card debt.”

She went on to explain how well they lived and how they had wanted for nothing. He was doing all the bills and responsible for taking care of the household money. They had been buying what they wanted, when they wanted, and taking very expensive vacations all on credit cards. Without her really understanding what was going on, they had refinanced the house a few times and even took out a second mortgage to consolidate the debt.

Debt encourages impulse buying and overspending. In a few studies from major credit card companies, consumers tend to spend on average 25 to 30 percent more when they charge than if they purchase with cash. This allows people immediate access to desired items, allowing them to pay for those items tomorrow; with interest. This makes the cost of the purchased item much more than the initial price; which does not seem to bother people today as long as they can have what they want NOW!!! I call this “Veruca Salt” Syndrome; I want I want I want it, NOW. Just put it on the plastic and then pay for it later, regardless of the interest or finance charges.

This results in the debtor’s future standard of living being lower, because money that is borrowed today must be repaid with interest over time. This drives the overall cost of the item up when you pay for it with interest over time. When you use debt, you presume that you will not have any pay reductions, no loss of job, or any unexpected expenses such as hospital bills. It seems that most people are in denial of what compounding interest does to the future cost of an item purchased on debt.

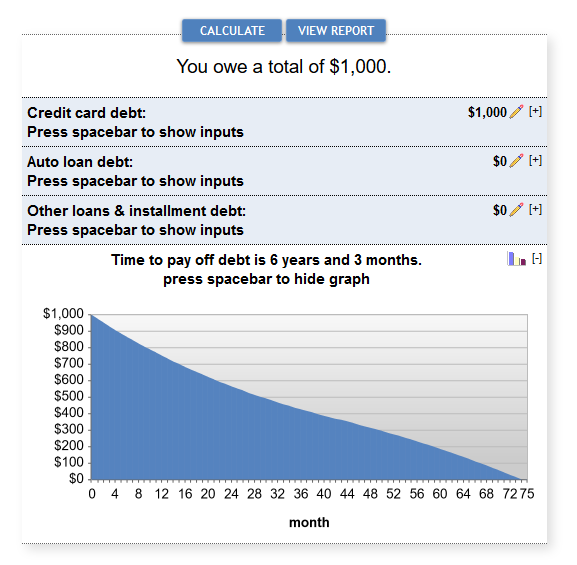

Let’s take a look at an example of how much you really pay for an item if you charge it.

- $1000 – Initial cost of item purchased

- 20% – Interest Rate

- Never charge anything else on the credit card

- Consumer pays minimum monthly

Payments

- $40.00 – Minimum Payment (4%)

- 6 Years 3 Months to pay off

- $2000 – Interest

- $3000 – Total cost of item

Debt allows us humans to throw judgement out the window and blur the lines between needs, wants, and desires.

- Needs – Necessary purchases such as housing, medical care, transportation, food, and clothing.

- Wants – Are emotional feelings about things you want, but you can make a choice in the quality of what you purchase. So designer clothing vs. functional clothing.

- Desires – These are items we desire but are not essential to our survival.

Many people purchase things for a lot of different reasons, but a few typical reasons are

- Depression

- Stress

- Fear

- Insecurity

- Low Self-Esteem

- Denial of financial status

- Veruca Salt Syndrome (pampered and pampered like a Siamese cat)

Whatever the reasons for spending out of control are, it takes a great deal of self-discipline to reverse the cycle and recover from the spending habit. It takes more than just cutting up the cards and stopping the spending, it takes a complete attitude adjustment and lifestyle change. Just like with alcoholics, it takes constant dedication to the process of change, and surrounding yourself with people that live the debt free lifestyle as a form of support.

Here are a few things you can do now to get started in your quest for a new debt free way of life.

- Imagine yourself debt free and making wise financial choices.

- STOP SHOPPING NOW

- Fill out a monthly income and expense sheet, and get a handle on what your financial picture is right now. CLICK HERE to Join our Budgeting Workshop and get hands-on with our easy-to-use spreadsheet! Learn how to create a budget, set up monthly cash flows, and take control of your money—step by step. Believe it or not, as painful as it is to see it in writing, it is also liberating to know where you stand.

- Set some realistic financial and life goals

- Work with Paul Stryer as your personal financial coach and get one-on-one support, accountability, and guidance to take your financial journey to the next level. HIRE PAUL NOW!!!

Breadcrumbs to Financial Freedom

Order your copy today and change your financial future forever. Order copies for all your friends and family this holiday season and give a gift that last a lifetime.

Breadcrumbs to Financial Freedom is your go-to guide for getting out of debt, building real wealth, and finally achieving financial independence. If you’ve ever felt stressed or stuck when it comes to managing your money, this book will walk you through simple, practical steps and help you shift your mindset so you can take control of your finances and turn things around. |

✅ Eliminate Debt: Learn proven strategies to pay off your debts and achieve financial freedom. |

Latest Blogs

The Liberating Lie: How Embracing ‘Less’ Can Give You More

Y’all ever been drowning in bills, feeling like your paycheck got kidnapped before it even hit your account? It’s like […]

Read MoreTransform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt!

Try Lumi The Love Bot Now! Transform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt! Valentine’s Day. […]

Read MoreThe Broke Romantic’s Valentine’s Survival Guide

Meet Lumi the Love Bot, your budget-savvy Cupid with a mission: “MAKE LOVE, NOT DEBT!” 💘 Lumi helps you craft […]

Read More