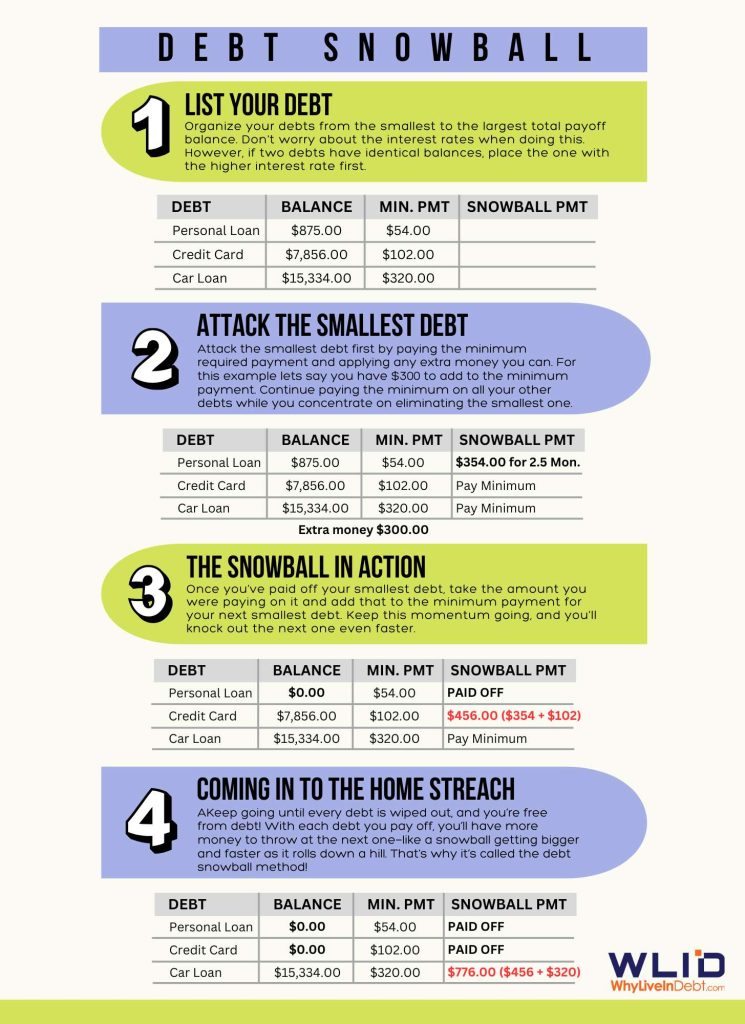

How To Eliminate Debt Using The Debt Snowball Method

The debt snowball method is a simple way to pay off your debt by focusing on one balance at a time, starting with the smallest. As you clear each debt, you build momentum to tackle the next one.

Here’s how it works:

- List your debts from smallest to largest, ignoring the interest rates.

- Make minimum payments on all your debts, except the smallest one.

- Put any extra money you can toward the smallest debt until it’s gone.

- Once it’s paid off, take the money you were putting toward that debt and add it to the payment on your next smallest debt.

- Repeat this process until every debt is paid off and you’re completely debt-free!

As you eliminate each debt, the money you can use to pay off the next one increases—just like a snowball growing as it rolls downhill. And knocking out that first small debt will give you the motivation to keep going until you’re debt-free!

Don't Go It Alone!!!!

Budgeting doesn’t have to be something you struggle with on your own. The Why Live In Debt Budgeting Workshop offers a supportive community where you can get the encouragement and accountability you need to succeed. Together, we’ll help you build a budget that actually works for you, so you can finally take control of your money and start feeling more confident about your financial future. Why not take this chance to change your relationship with money and start living with less stress?

Don't Go It Alone!!!!

Budgeting doesn’t have to be something you struggle with on your own. The Why Live In Debt Budgeting Workshop offers a supportive community where you can get the encouragement and accountability you need to succeed. Together, we'll help you build a budget that actually works for you, so you can finally take control of your money and start feeling more confident about your financial future. Why not take this chance to change your relationship with money and start living with less stress?

Learn MoreRelated Blogs

The Liberating Lie: How Embracing ‘Less’ Can Give You More

Y’all ever been drowning in bills, feeling like your paycheck got kidnapped before it even hit your account? It’s like […]

Read MoreTransform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt!

Try Lumi The Love Bot Now! Transform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt! Valentine’s Day. […]

Read MoreThe Broke Romantic’s Valentine’s Survival Guide

Meet Lumi the Love Bot, your budget-savvy Cupid with a mission: “MAKE LOVE, NOT DEBT!” 💘 Lumi helps you craft […]

Read More