The Starbucks Trap: How Coffee Could Be Sabotaging Your Finances

I’m sure if you have been following my blogs, and if you looked at the title of this blog you most likely are thinking I’m going to talk about your job and trading time for money. Or you might think I’m going to talk about going to work day after day, and living pay check to pay check and never really getting ahead. Although these are all great subjects that I have briefly talked about in my past blogs, you are going to be pleasantly surprised at the true nature of this blog.

In this blog I’m going to move away from the how and why we get into debt, and move into some more practical tips that you can start using now to exercise your new debt free muscles.

Today we are going to talk coffee!

“Surprise, Surprise, Surprise”, to quote Gomer Pyle. Yes you heard me right we are going to talk coffee, java, Cup Of Joe, or whatever else you call that extremely gross stuff most humans drink every morning to wake up. It has gotten to the point where many of my friends and co-workers cannot even function until they have started on their 2nd or 3rd glass of coffee in the morning. They continue to pour the stuff down their gullet all day and into the evening, then they wonder why they can never get a good night sleep.

Many of my friends have a daily ritual of hitting one of the ever popular premium coffee joints such as Starbucks, or Mr. Bean and spending $5+ dollars on a fancy coffee drink I cannot even pronounce the name of, let alone figure out what they just ordered. Then the sales person askes what size would you like your drink, and again I have no clue what they just said.

And most people don’t stop with just the crazy named coffee drink, they have to get the little lemon pound cake for another $3+ dollars. So now your single trip to the coffee house is giving you a one way ticket to the poor house. And just imagine if a person was to make this trip two, three or even more times per day. At an average of $8 a trip times two trips per day and you are at $16 per day. Or if you look at the bigger picture that if you made two stops per day, your grand total would be $5,840 per year. I think you can see where I’m going with this blog at this point.

So now that you are most likely laughing at my lack of knowledge of the Starbucks culture, I will tell you that I don’t drink coffee. So I figured I didn’t needed to learn the language of ordering coffee. But what I did figure out one day in August of 2007, was the language of how much those fancy coffees drinks are costing the Joneses of the world.

How much did you say that coffee cost?

So in August of 2007 I met a person who shall remain anonymous, so let’s call her Natasha. As I got to know Natasha I soon realized that she like many of my friends had an infinity for the Starbucks culture. As Natasha and I became closer we co-mingled money as many couples do, when they start to cohabitate. Since I have been using Quicken to track my finances since the early 90s, it was only natural to add her financial data in my quicken file.

As Natasha and I became closer and began sharing our lives together, I was able to train myself to get past the smell of burnt coffee. We would share time together hanging at Starbucks. And every time the price would pop up on the cash register my heart would drop at the sight of the price tag. So one day I decided I would make a special category in my Quicken account called Starbucks.

Yep you guessed it I started tracking Natasha’s habit in Quicken, unbeknownst to her. So over the course of a couple of months I tracked her spending habits that related to coffee. Some days she would only go once, some days more than once. Some days she would get food with her order and some days she would not.

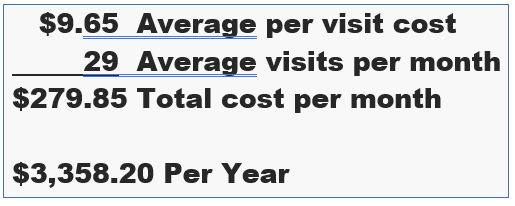

Here is what it looks like when you wake up and smell the java.

Holy Coffee Bean, Bat Man!!

When I first ran the report in quicken I thought I had done something wrong and ran the report two more times. The only way I believed the report was to have it list out all the entries day by day and I added them up on a calculator to make sure the number were correct.

So at this point I could have done one of two things. One I could have gotten mad and just put my foot down and yelled and screamed till I was blue in the face. But being in a new relationship I opted for option number two which was a little more civil. Option two was a three pronged approach.

First I went out and bought her a Kuerig and a huge supply of the K cups. The cost of both was about the amount of one month of Starbucks, so I figured it would be paid for itself in about one month.

Second I went out and purchased a really cool annual thermos mug from a local bagel shop that she also liked to get coffee and bagels at. Once a year they would sell these cups around Christmas for $129, and you could refill them as many time as you wanted for a one year.

Third I presented both of these items to her as a gift, and she was very excited about all of the above. So it was a win – win situation for the cost of 1.5 month of Starbucks we reduce our total cost of her daily habit, and put money back in our budget.

Ultimately I did explain to her the real reason for the gifts and how it will help our household budget. And she still gets her daily fix of coffee and being social by getting her mug filled at the bagel place.

From then on she would mix it up some days she would take her coffee from home and some days she would stop at the bagel place.

Another Great Idea to Save On Coffee

Recently another very close friend of mine who also needs the IV coffee drip in the morning to get started, shared with me her method of still getting to enjoy her time at Starbucks with her friends, but does not kill her monthly budget.

This person has a Starbucks gift card that is rechargeable, and she put $25 per month on this card. When the card runs out of money she cannot go to Starbucks again till the next month. This allows her to still enjoy the time spent with her friends and enjoying those fancy coffee drinks.

So as you can see she has budgeted $25 in to her monthly budget, so she does not have to cut her enjoyment off completely, but at the same time she has put in place the tools to make sure she does not go over budget. The rest of the month she makes her coffee at home in the morning, as well as drinks the coffee provided by her employer..

How Can You Take Action Today

Here are a few things you can do now to get started in your quest for a new debt free way of life.

- Imagine yourself debt free and making wise financial choices.

- Stop buying fancy coffee NOW

- Make your coffee at home

- Drink your employer provided coffee

- Sets some realistic financial and life goals

- Start working our time tested methods in our course Breadcrumbs to financial freedom.

Breadcrumbs to Financial Freedom

Order your copy today and change your financial future forever. Order copies for all your friends and family this holiday season and give a gift that last a lifetime.

Breadcrumbs to Financial Freedom is your go-to guide for getting out of debt, building real wealth, and finally achieving financial independence. If you’ve ever felt stressed or stuck when it comes to managing your money, this book will walk you through simple, practical steps and help you shift your mindset so you can take control of your finances and turn things around. |

✅ Eliminate Debt: Learn proven strategies to pay off your debts and achieve financial freedom. |

Latest Blogs

The Liberating Lie: How Embracing ‘Less’ Can Give You More

Y’all ever been drowning in bills, feeling like your paycheck got kidnapped before it even hit your account? It’s like […]

Read MoreTransform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt!

Try Lumi The Love Bot Now! Transform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt! Valentine’s Day. […]

Read MoreThe Broke Romantic’s Valentine’s Survival Guide

Meet Lumi the Love Bot, your budget-savvy Cupid with a mission: “MAKE LOVE, NOT DEBT!” 💘 Lumi helps you craft […]

Read More