Year-End Blog: Get Ready for 2025 – Break the Cycle and Take Charge of Your Future

Summary

As 2024 draws to a close, it’s time to reflect on your financial journey. Are you still stuck in the paycheck-to-paycheck cycle? Do you feel like you’re trying but never succeeding? If so, 2025 is your year to take control.

In this blog, we’ll explore:

- The common reasons people procrastinate or live in denial about their finances.

- How your relationship with money impacts your success.

- Actionable steps to make a financial plan that works.

- The transformative power of financial coaching.

This isn’t about wishful resolutions. It’s about real change—so you can finally achieve financial freedom and build a life you love.

Why We Stay Stuck: Understanding Procrastination and Denial

Procrastination and denial are two of the biggest barriers to overcoming financial struggles. They keep us stuck in unhealthy cycles, year after year. Let’s break it down:

- The Comfort of Procrastination

Procrastination is a thief. It steals your time and opportunities, leaving you further behind with each passing day. But why do we procrastinate, especially with something as important as our finances?

- Fear of Change: The unknown is scary. Even when our current situation is bad, it’s familiar, and familiarity feels safe.

- Overwhelm: When faced with mounting debt or financial chaos, it’s easy to feel paralyzed. “Where do I even start?” is a common refrain.

- Short-Term Thinking: We focus on immediate comforts rather than long-term gains. Skipping a coffee run today feels like a drop in the ocean compared to larger financial goals.

- The Power of Denial

Denial is a coping mechanism. It allows us to avoid confronting uncomfortable truths, but at a cost. Living in denial about your financial struggles can lead to:

- Accumulating debt.

- Missed opportunities for saving or investing.

- Prolonged stress and anxiety.

Learn more about breaking free from denial by reading this blog: http://whyliveindebt.com/denial

Breaking Free

To escape procrastination and denial, you need awareness and action. Recognizing these patterns is the first step. The next step is addressing your mindset and relationship with money.

Changing Your Relationship With Money: The Key to Financial Freedom

Your financial habits are deeply tied to your beliefs and emotions about money. To achieve lasting financial freedom, you must fundamentally change your relationship with money.

Why Your Money Mindset Matters

- Money as a Tool, Not a Threat: Many people view money as a source of stress, leading to avoidance behaviors. Instead, think of money as a tool to achieve your goals.

- Scarcity vs. Abundance: A scarcity mindset says, “I’ll never have enough.” An abundance mindset says, “I can create opportunities.”

Steps to Shift Your Money Mindset

- Identify Limiting Beliefs:

Write down phrases you associate with money (e.g., “Money is the root of all evil”). Challenge these beliefs by seeking examples that contradict them. - Practice Gratitude:

Gratitude rewires your brain to focus on what you have rather than what you lack. Make a habit of listing three things you’re grateful for every day. - Visualize Success:

Picture your ideal financial future. Where are you living? How are you spending your time? Use this vision to stay motivated. - Commit to Learning:

Money isn’t something most of us learn in school. Take the time to read books, attend seminars, or work with a coach to fill in the gaps.

Action Steps: Make a Plan and Work the Plan

The cornerstone of financial success is a solid plan. Here’s how to create one:

Step 1: Build a Budget

Budgeting for 2025 starts with knowing where your money is going.

- Track Expenses: Use a spreadsheet or an app to categorize your spending.

- Set Priorities: Allocate funds to needs (housing, utilities) before wants.

- Stick to It: Review your budget weekly to ensure you’re on track.

Step 2: Start Saving

An emergency fund is non-negotiable. Start with a small goal, like $1,000, and grow from there.

Step 3: Attack Debt

Debt snowballing is a proven method:

- List debts from smallest to largest.

- Pay off the smallest while making minimum payments on others.

- Roll payments into the next debt once one is cleared.

Step 4: Automate Your Success

Set up automatic transfers for savings and bills. Automation reduces the temptation to overspend.

Step 5: Review and Adjust

Your financial plan isn’t static. Revisit it monthly to make adjustments based on your progress and changing needs.

Why Financial Coaching Can Transform Your Journey

Financial coaching offers more than advice—it provides a partnership for success.

The Benefits of Hiring a Financial Coach

- Personalized Guidance: A coach helps you navigate your unique challenges and goals.

- Accountability: Regular check-ins keep you focused and on track.

- Support and Encouragement: Your coach is both a guide and a cheerleader, celebrating wins and helping you through setbacks.

As someone who’s been in your shoes, I understand the struggles of breaking free from financial chaos. That’s why I’m passionate about helping others achieve financial freedom.

To learn more about coaching check out my coaching page: http://whyliveindebt.com/coaching/

Resources to Jumpstart Your Journey

- Subscribe to My Newsletter:

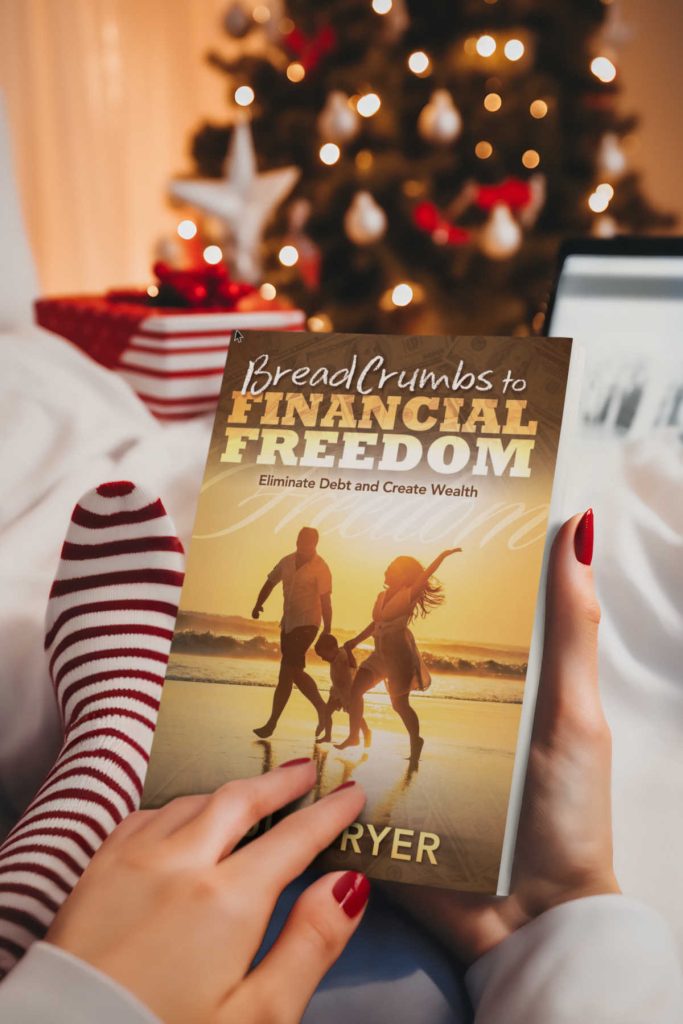

Your Wealth Guide provides practical tips, motivation, and insights to keep you moving forward. http://whyliveindebt.com/yourwealthguide - Read My Book:

Breadcrumbs to Financial Freedom outlines actionable steps to transform your relationship with money and achieve lasting success. http://whyliveindebt.com/breadcrumbs - Book a Free Consultation:

Let’s discuss your goals and how financial coaching can help you reach them. http://whyliveindebt.com/freeconsult

Make 2025 Your Breakthrough Year

This year, don’t just dream of financial freedom—take action. With the right mindset, a solid plan, and the support of a coach, you can break the paycheck-to-paycheck cycle, build wealth, and create a life you love.

Let’s make 2025 the year you take control. You’ve got this, and I’m here to help every step of the way.

Latest Blogs

The Liberating Lie: How Embracing ‘Less’ Can Give You More

Y’all ever been drowning in bills, feeling like your paycheck got kidnapped before it even hit your account? It’s like […]

Read MoreTransform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt!

Try Lumi The Love Bot Now! Transform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt! Valentine’s Day. […]

Read MoreThe Broke Romantic’s Valentine’s Survival Guide

Meet Lumi the Love Bot, your budget-savvy Cupid with a mission: “MAKE LOVE, NOT DEBT!” 💘 Lumi helps you craft […]

Read More

Breadcrumbs to Financial Freedom

Order your copy today and change your financial future forever. Order copies for all your friends and family this holiday season and give a gift that last a lifetime.

Breadcrumbs to Financial Freedom is your go-to guide for getting out of debt, building real wealth, and finally achieving financial independence. If you’ve ever felt stressed or stuck when it comes to managing your money, this book will walk you through simple, practical steps and help you shift your mindset so you can take control of your finances and turn things around. |

✅ Eliminate Debt: Learn proven strategies to pay off your debts and achieve financial freedom. |