20 Quick and Easy Ways to Cut Expenses and Get Control of Your Finances

Are you tired of living paycheck to paycheck, stressing over money, or feeling like the month drags on longer than your budget? If these questions hit home, it’s time to make some changes. Years ago, I was in the same situation—constantly stressed and watching my finances spiral. It was tough, and I knew something had to give.

I reached a point where I felt I’d hit rock bottom. That’s when I came across a quote by Henry Cloud:

“We change our behavior when the pain of staying the same becomes greater than the pain of changing.”

I decided to start cutting back on anything and everything, no amount was too small. I sold my Harley, canceled cable, stopped eating out, and downsized. Fast forward to today: life is less stressful, and for the first time, there’s money left over each month.

I can truly say LIFE IS GOOD.

If you’re in a tough spot financially, let’s take this one step at a time. I get it—when things are overwhelming, you don’t even know where to begin. A good starting point? Taking a clear look at what’s coming in and going out.

Follow these steps to start your journey:

Track Your Finances: Start by downloading a budgeting spreadsheet (like the one on my site http://whyliveindebt.com) or using a notebook to record every dollar you earn and spend. When everything’s written down, it’s so much easier to spot areas to cut back.

List Your Cuts: After seeing your budget clearly, make a list of expenses you can reduce or eliminate. Even small changes make a big impact.

Work the Plan: As you cut each expense, note how much you’re saving each month. Tracking your progress will keep you motivated.

Attack Your Debt: Put those savings directly toward paying off debt. The sooner you’re debt-free, the faster you can build the future you want.

Ready to cut expenses? Here are 20 quick and easy ideas to help get started:

Expense Reduction Ideas

Hold Off on New Phones

Avoid upgrading to the latest phone every year. Try to keep your device for at least five years and avoid contracts. Older phones can be handed down, saving even more.Shop Around for Cell Plans

Cell phone plans change constantly. Take advantage of deals, especially from newer carriers, to save on monthly costs.Programmable Thermostats

A programmable thermostat helps keep utility bills low by automatically adjusting the temperature when you’re away. Set it and forget it to save up to 15% each year.Adjust Home Temperatures

In summer, keep it a little warmer, and in winter, a little cooler. We keep it at 79°F in summer and 69°F in winter—small changes like this can really cut costs. You could even raise the temperature in your refrigerator one degree at a time, and lower your water heater temperature to save a few more penny’s per month.Review Property Taxes

If your home’s value has dropped, request a re-evaluation to potentially lower your property taxes.Drive Mindfully

Slow down and ease into accelerations. Driving with a “light foot” can help save on gas.Declutter Your Car

Extra weight impacts fuel economy. Removing about 100 pounds can improve fuel efficiency by 2%.Check Tire Pressure

Underinflated tires affect fuel economy. Keeping them properly inflated saves on gas.Keep Up with Car Maintenance

A well-maintained car performs better and uses fuel more efficiently. Stick to your maintenance schedule.Avoid ATM Fees

Withdraw cash from your bank’s ATM or take out larger amounts to reduce fees, which add up fast.Use a Shopping List

Before shopping, make a list. It helps you avoid impulse buys, keeping your budget on track.Eat Before You Shop

Going to the store on an empty stomach can lead to unnecessary splurges.Skip the Organic Label

Not every item needs to be organic, and choosing non-organic on certain items can stretch your grocery budget.Cut Down on Eating Out

Eating out can be costly. Try meal-prepping or packing lunches for work to save.Quit Smoking

Besides health benefits, quitting smoking saves you significant cash—about $2,000+ a year for a pack-a-day habit.Ditch Cable

Cable is pricey. Try a single streaming service for a fraction of the cost.Reduce Internet Speed

If you’re only browsing and streaming, you may not need high-speed internet. Downgrade for potential savings.Cancel Non-Essential Subscriptions

Newspaper, magazines, satellite radio—all these add up. Keep only the subscriptions you truly use.Rethink Your Gym Membership

If you barely use it, cancel it. There are countless free online workout resources to stay active.Cancel Unused Streaming Services

Many of us have multiple streaming subscriptions but only watch one or two. Take a look and cancel the ones you rarely use.- BONUS Savings Idea

Shop your auto and home insurance yearly, and change providers for savings. I will shop companies and when I find the best price I will take that to my current provider and most of the time they will meet or beat the other companies price and saving me the hassle of changing providers.

Remember, small changes lead to big results. Every dollar you save brings you closer to financial peace and a more stress-free life. I look forward to helping you along the way, and remember:

each new day is another chance to change your life – you just have to find the right path and take action.

Latest Blogs

The Liberating Lie: How Embracing ‘Less’ Can Give You More

Y’all ever been drowning in bills, feeling like your paycheck got kidnapped before it even hit your account? It’s like […]

Read MoreTransform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt!

Try Lumi The Love Bot Now! Transform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt! Valentine’s Day. […]

Read MoreThe Broke Romantic’s Valentine’s Survival Guide

Meet Lumi the Love Bot, your budget-savvy Cupid with a mission: “MAKE LOVE, NOT DEBT!” 💘 Lumi helps you craft […]

Read More

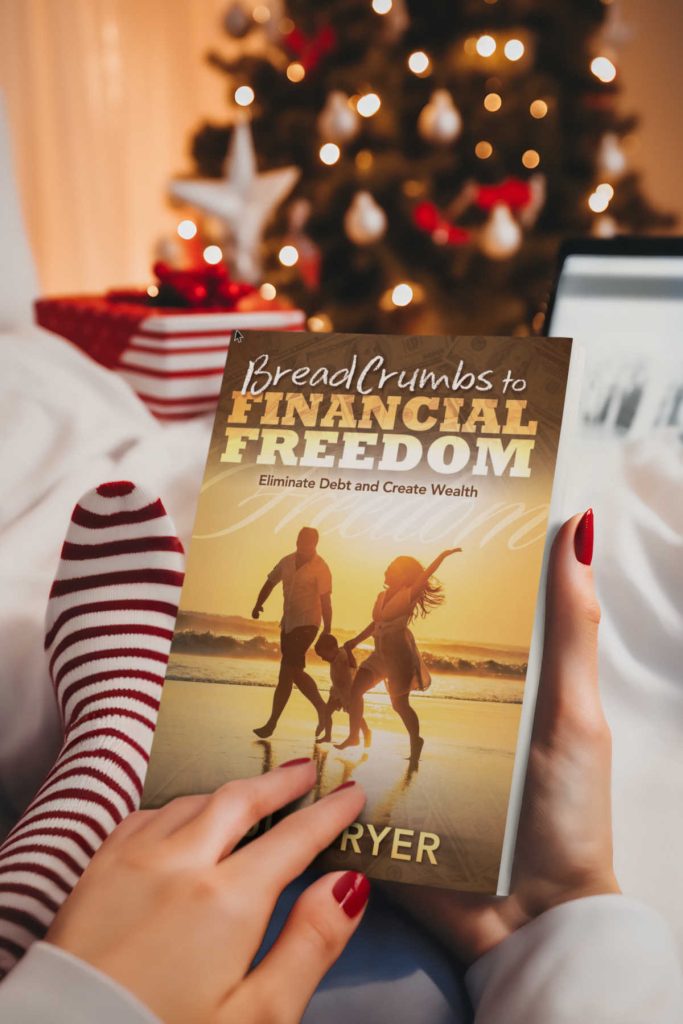

Breadcrumbs to Financial Freedom

Order your copy today and change your financial future forever. Order copies for all your friends and family this holiday season and give a gift that last a lifetime.

Breadcrumbs to Financial Freedom is your go-to guide for getting out of debt, building real wealth, and finally achieving financial independence. If you’ve ever felt stressed or stuck when it comes to managing your money, this book will walk you through simple, practical steps and help you shift your mindset so you can take control of your finances and turn things around. |

✅ Eliminate Debt: Learn proven strategies to pay off your debts and achieve financial freedom. |