From Debt and Chaos to Financial Freedom: How to Take Your First Step Today

How Did I Get Here, A Call To Action:

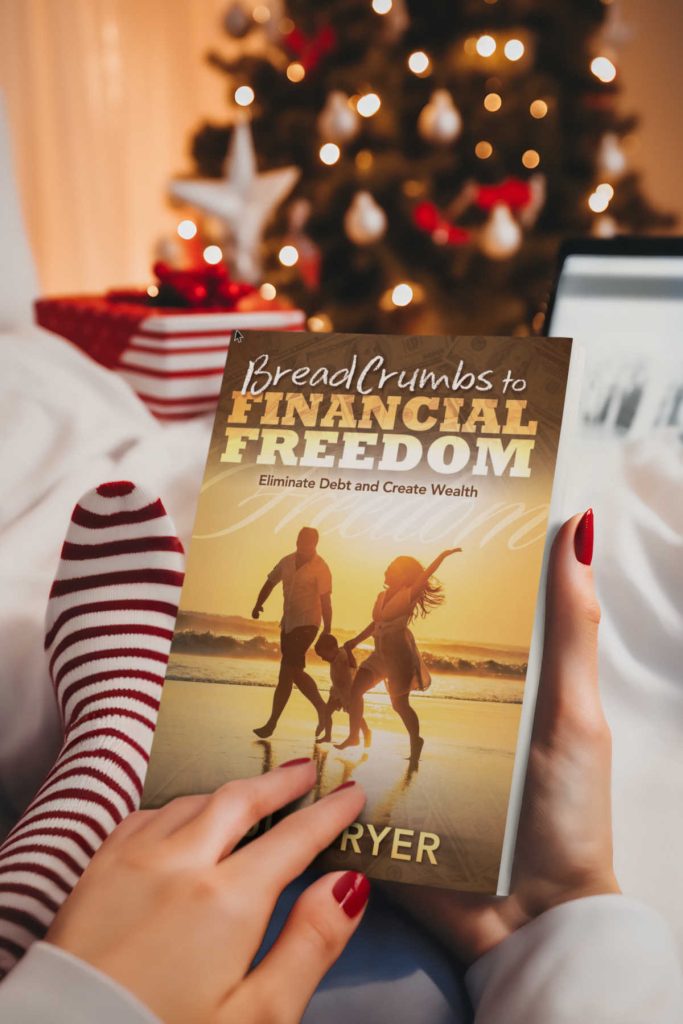

Hello I’m Paul Stryer founder of Why Live In Debt Dot Com, and the author of the book Breadcrumbs To Financial Freedom. Today I want to take a different direction in my blog, and hopefully inspire you the readers to stop living in denial and open up about what you have, or are going through in your financial life.

In my quest to help other people transform their lives from that of stress, and constant chaos to financial freedom, I have noticed a very common theme with many of the wonderful people I have helped. The theme is DENIAL, yes that is right denial. Many of the people that I have helped up to this point have been living in denial about the status of their financial life, and are in what I call ignore mode. If I ignore that pesky debt each month, then maybe it will go away and stop bothering me. Or if I ignore it than it must not exist. Are you one of those people in Ignore mode? If you want to read more about denial go check out my blog “Breaking the cycle of financial denial”, to hear about a real life denial story.

So, in this blog I want to start a dialog with you the readers, and get you participating in a conversation about; where you are financially, and how you got there. Most people do not like to talk about their financial issues because it makes them feel like a failure or a looser. But what I have found is that people that open up about their financial issues, are way more likely to be successful in their financial recovery. And those that continue to deny their situation, more often than not continue to be stuck in a infinite loop of financial & life issues.

Here is what I’m proposing for this blog. I will start off the conversation by telling my own story, here in this blog. Then it is your turn, just bite the bullet and respond in the comments below this blog with your story of how and why you are in the financial situation that you are in. And if you are already well into your financial recovery, and building wealth we want to hear your story also to help inspire those that are just starting their journey.

Here Is My Story:

My financial story really starts as far back as I can remember, all the way back to childhood. There were many reasons why I got into the financial mess I was in; but at the root was my lack of money education. My parents and my school never once talked about money, so when I was shipped off at 18 I was clueless. In my early years, I was in the music industry, which meant I was always broke. Since I grew up pampered in a middle class home, I used credit cards to supplement my non-existent income to maintain the life I was accustom to. I bought cars, music equipment, clothes, weekend getaways, dining out, renting more than I could afford, all on credit.

My bad financial habits followed me into my Network Engineering career, and right into both of my failed marriages. If there was ever a bad way to start a marriage, starting out with a ton of debt and bad financial habits is a recipe for disaster. When the marriages became unstable I doubled down on the bad financial choices to try and save the marriages, which was the completely opposite thing I should have been doing. And my excuse at the time was I was just too busy living life, building a career, being a husband, and father that there was just no time left to figure out how to get my financial life figured out.

For many years I would lay in bed at night and would almost bring myself to hyperventilation with the thoughts of how bad my financial and life situation were. At the same time, due to many reasons including the financial ones, my 2nd marriage crumbled in to oblivion. At this point I had hit rock bottom and was in more pain than I had ever experienced to this point in my life.

Now I’m sure if you have ever listened to Tony Robbins you will know he talks about how most people will never make positive changes in their life until the pain they are feeling is way more painful, then the pain and energy it would take to change their life. And I was at that point. I was all alone with two children that I had to raise, and a BIG FAT financial mess to clean up.

One night late in 2012, I sprang from my bed and jumped on my computer (figuratively speaking of course). I searched the net and read as many debt blogs as I could and checked out as many methods as I could to resolve my debt. I created the income and expense spreadsheet and you can download the Financial TookKit here (use coupon freetookit). After many hours pounding away at my computer, I had filled in my new spreadsheet and my eyes glazed over when I saw the numbers in the balance summary. Before my 2nd wife left our two incomes was hiding our true financial situation, and now with one income I was going many thousands of dollars in the whole each month.

It was time to wake up, and take control

The next morning I reviewed my spreadsheet again, and as my mentor had taught me I MADE A PLAN, and I began to WORK THE PLAN. I started cutting expenses everywhere. There was no expenses left standing that did not get removed from my life or at least trimmed. My friends thought I was crazy because I sold my Harley Davidson, and my kids thought I had lost my mind because I shut off cable TV. I cut, and I cut and I cut, and even to this day when I’m in the best financial place of my life to date, I still look every day for ways I can cut my expenses or increase my income.

I was in denial like many of you are right now, and I can tell you it is very liberating to tell other people your story and not live in the shadows anymore. Today I’m well into my financial recovery, and I have to say I’m happier then I have ever been. And to top it off I’m getting to share my new found skills and knowledge with people that are in the same pain I was in just a few short years ago.

I’m looking forward to hearing your stories in the comments below this blog. So don’t forget to share your story in the comment section below. Thank you for listening to my story, and as always thank you for stopping here at WhyLiveInDebt.com.

How Can You Take Action Today:

Here are a few things you can do now to reduce expenses and get started in your quest for a new debt free way of life.

- Imagine yourself debt free and making wise financial choices.

- Wake up, like I did that fateful night, and stop living in denial. Acting like you don’t have a debt problem does not make it so. Check out my blog, Why Live In Debt: Denial

- STOP SHOPPING NOW!

- Fill out a monthly income and expense sheet and get a handle on what your financial picture is right now. CLICK HERE (coupon code freetoolkit) to download our Google spreadsheet that will help you see where you stand. Believe it or not, as painful as it is to see it in writing, it is also liberating to know where you stand.

- Sets some realistic financial and life goals

- Start working our time tested methods in my book Breadcrumbs to Financial Freedom. OR

- Sign-up for a free 30 minute Zoom financial coaching consultation and let see if financial coaching is right for you. CLICK HERE to go to my calendar and reserve your spot today.

I look forward to working with each and everyone one of you in the near future, and remember, each new day is another chance to change your life – you just have to find the right path and take action.

Latest Blogs

The Liberating Lie: How Embracing ‘Less’ Can Give You More

Y’all ever been drowning in bills, feeling like your paycheck got kidnapped before it even hit your account? It’s like […]

Read MoreTransform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt!

Try Lumi The Love Bot Now! Transform Your Valentine’s Day with Lumi the Love Bot: Love Without Debt! Valentine’s Day. […]

Read MoreThe Broke Romantic’s Valentine’s Survival Guide

Meet Lumi the Love Bot, your budget-savvy Cupid with a mission: “MAKE LOVE, NOT DEBT!” 💘 Lumi helps you craft […]

Read More

Breadcrumbs to Financial Freedom

Order your copy today and change your financial future forever. Order copies for all your friends and family this holiday season and give a gift that last a lifetime.

Breadcrumbs to Financial Freedom is your go-to guide for getting out of debt, building real wealth, and finally achieving financial independence. If you’ve ever felt stressed or stuck when it comes to managing your money, this book will walk you through simple, practical steps and help you shift your mindset so you can take control of your finances and turn things around. |

✅ Eliminate Debt: Learn proven strategies to pay off your debts and achieve financial freedom. |